How To Sign Your Pennsylvania Title

If you’re getting ready to sign your Pennsylvania vehicle title, this guide will walk you through the process clearly and confidently. It covers where to sign and how to print your name properly, what steps to take if more than one person owns the vehicle and why accuracy matters to keep the transfer legal. You’ll also pick up useful tips, like the best type of pen to use and common pitfalls to avoid that could void your title. And if anything is unclear or you need assistance along the way, you’ll know exactly who to reach out to for reliable support.

The person (or persons)* listed on the front of the title must follow these steps, unless otherwise noted:

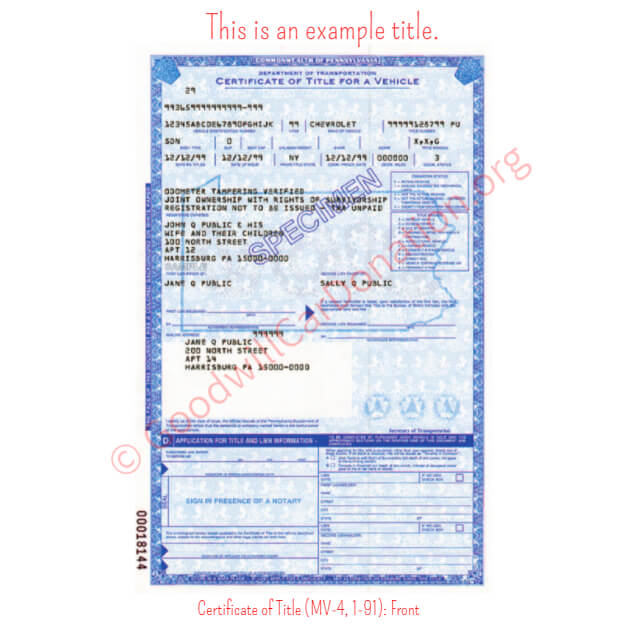

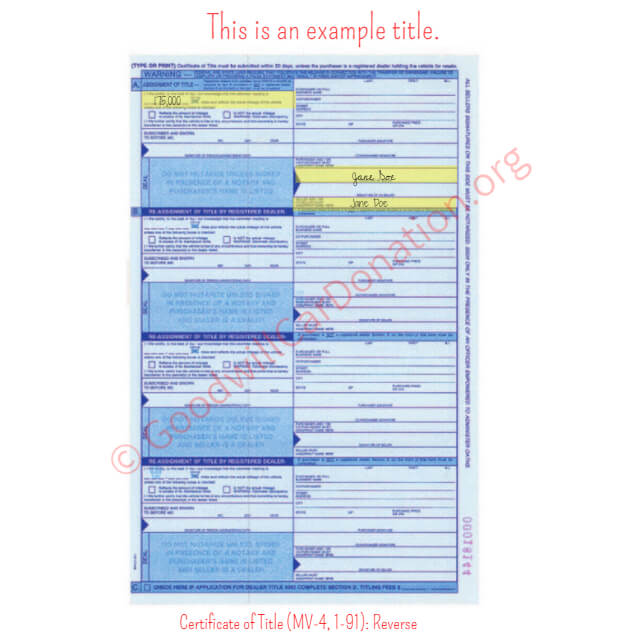

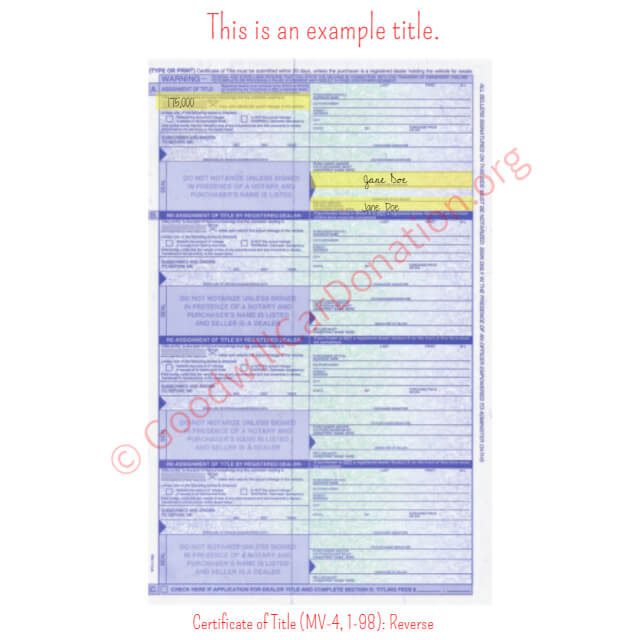

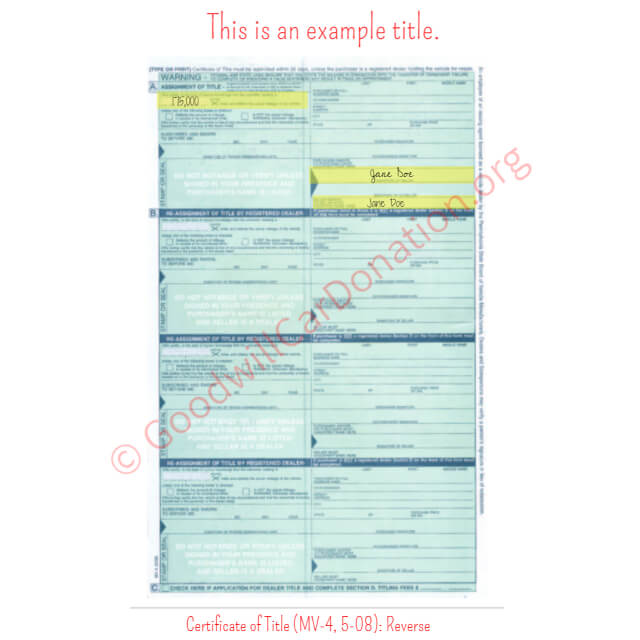

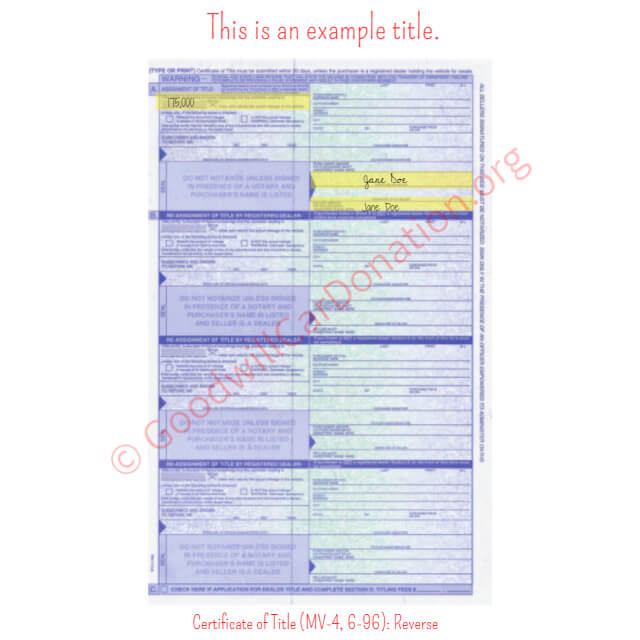

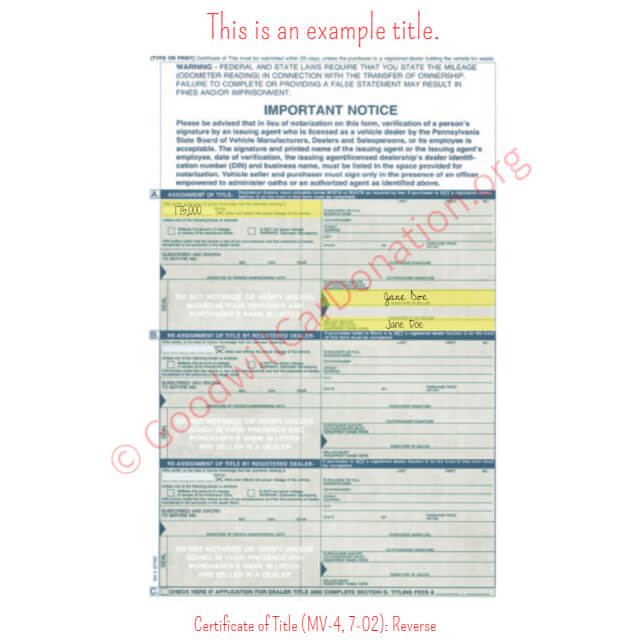

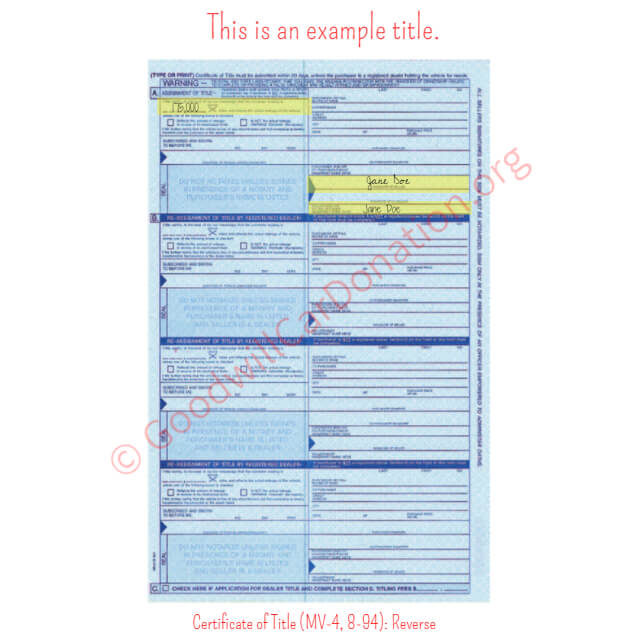

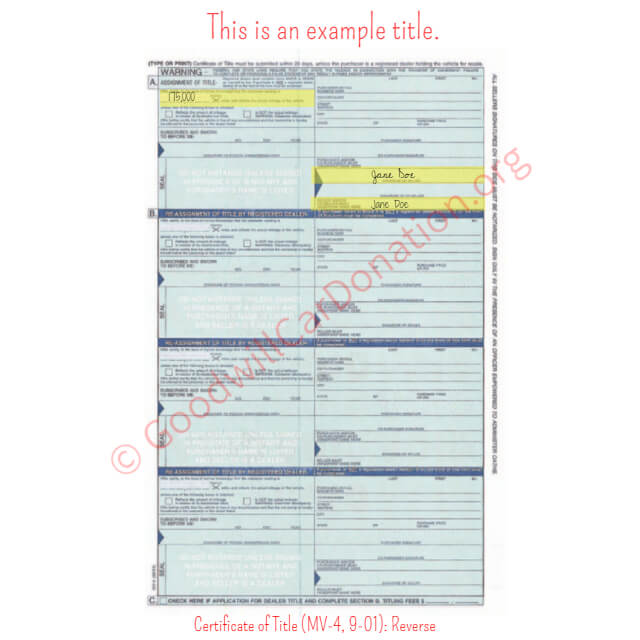

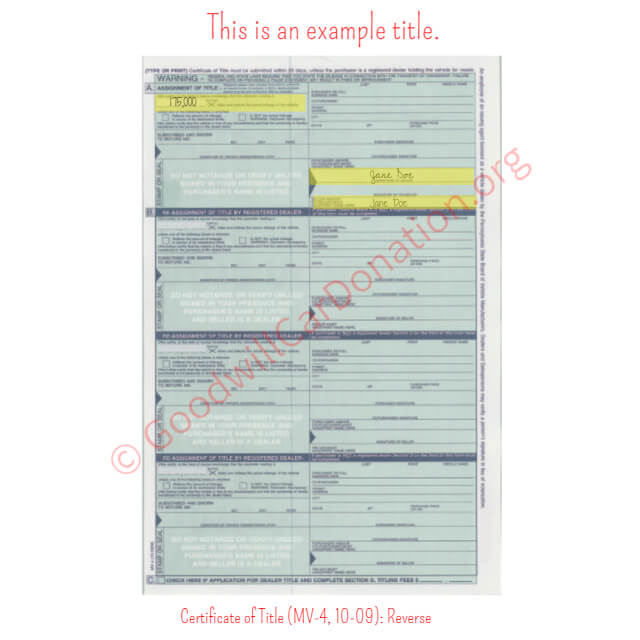

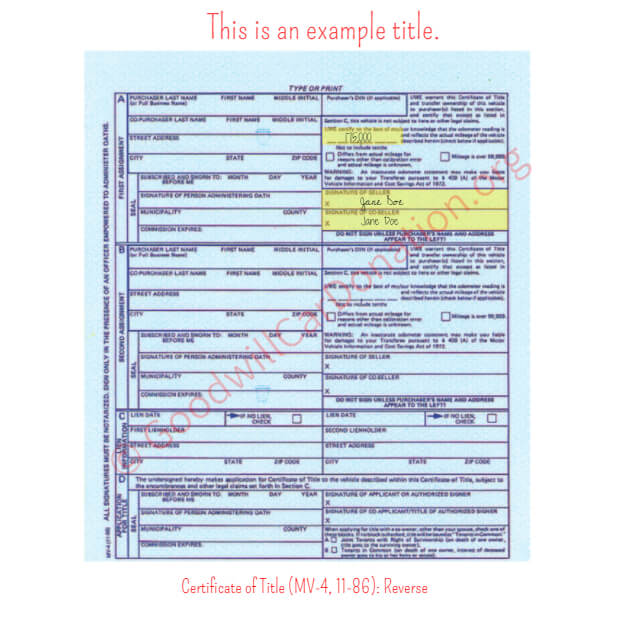

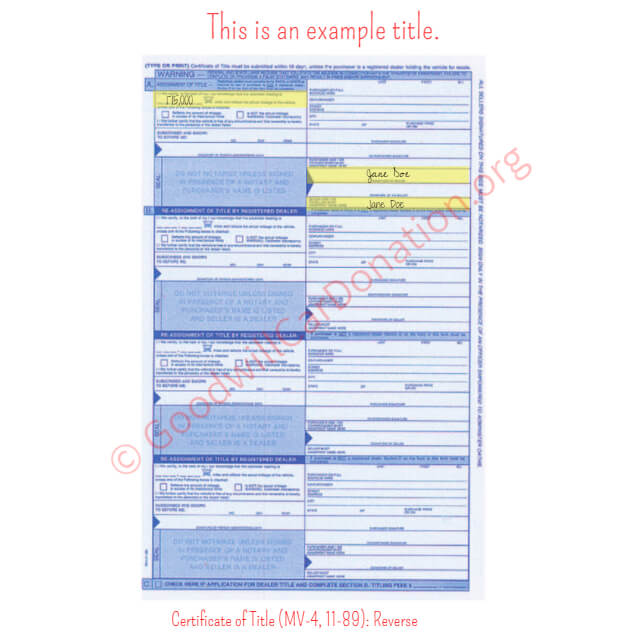

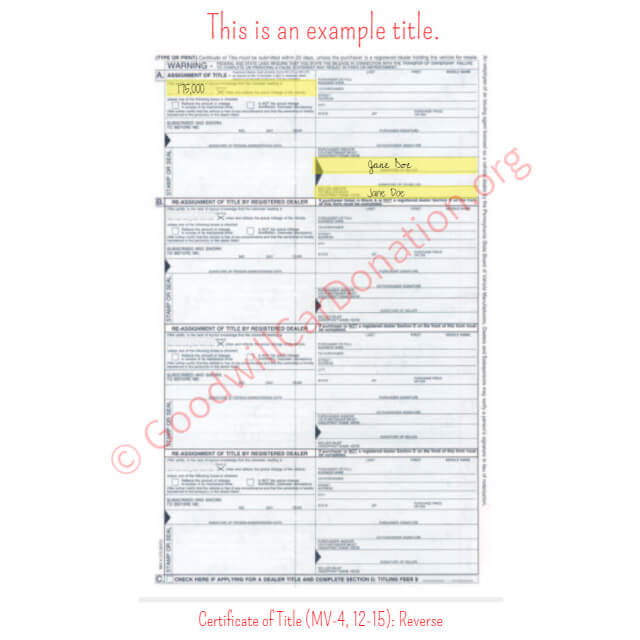

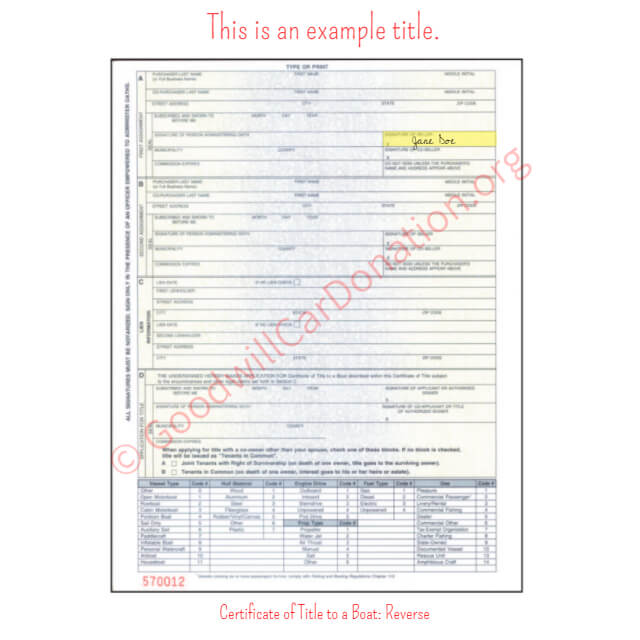

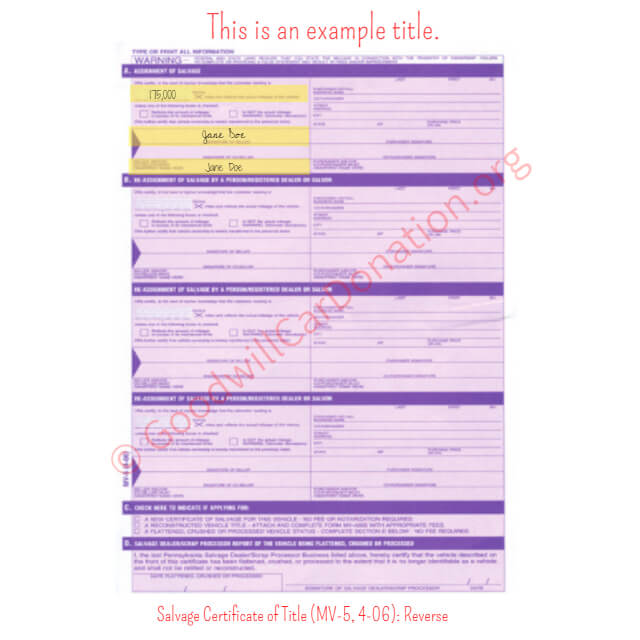

- For motor vehicle donations, please include the current odometer reading – normally found on the back of the title, top left-hand corner.

- Sign your name (or names)* on the back of the title where it says “Signature of Seller”.

- Print your name (or names)* on the back of the title where it says “Seller and/or Co-Seller Must Hand Print Name Here”.

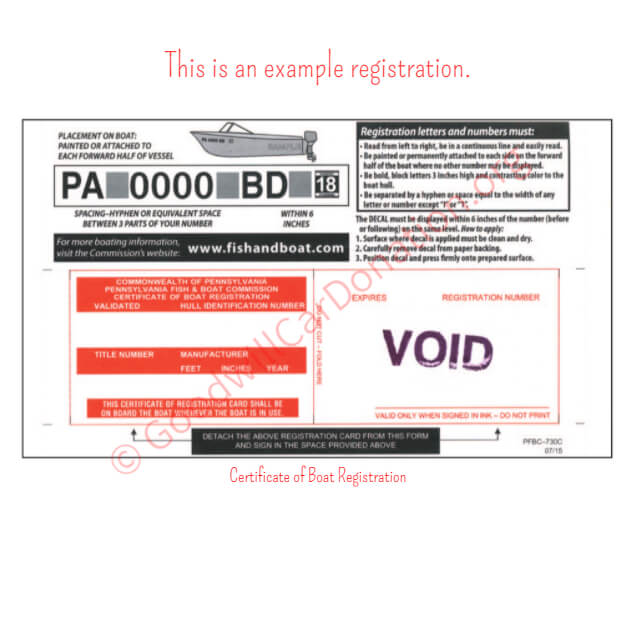

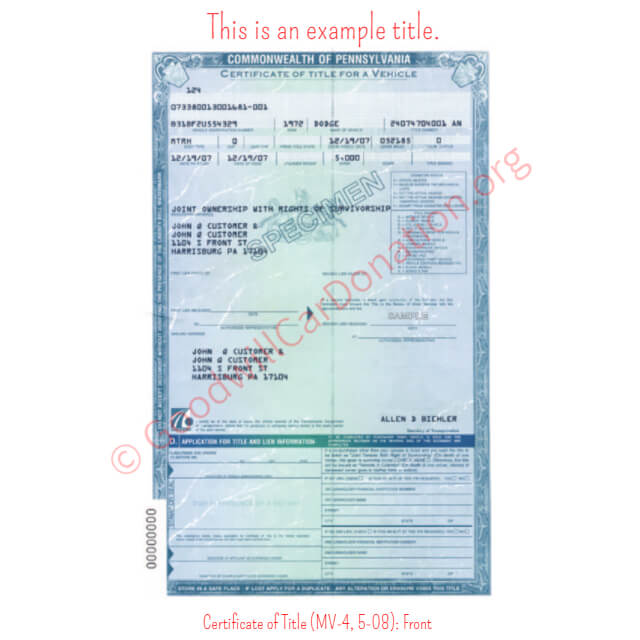

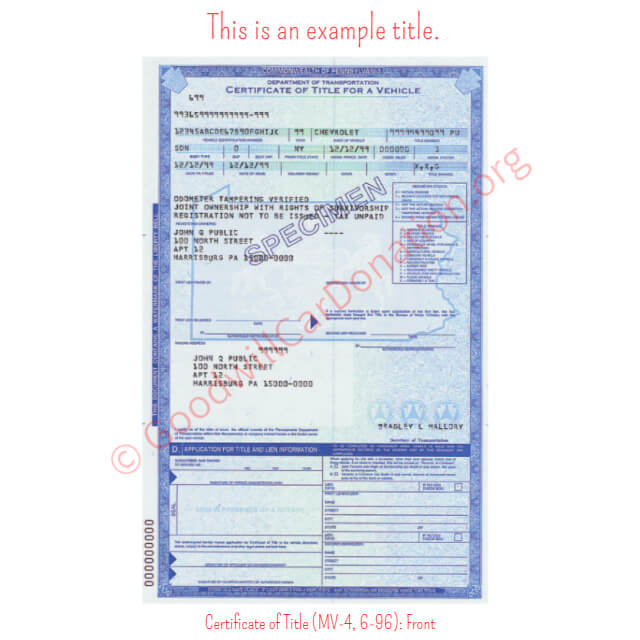

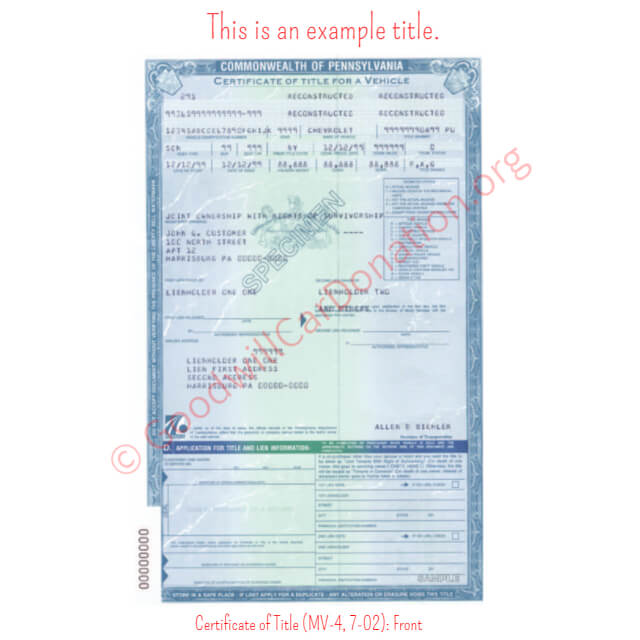

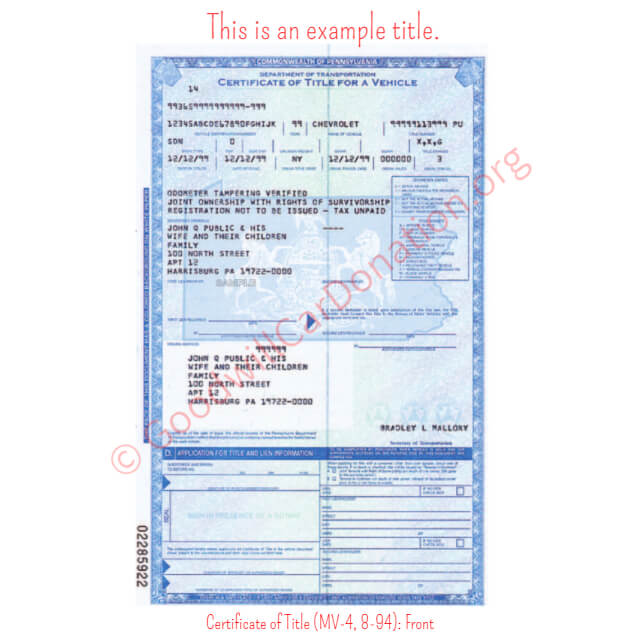

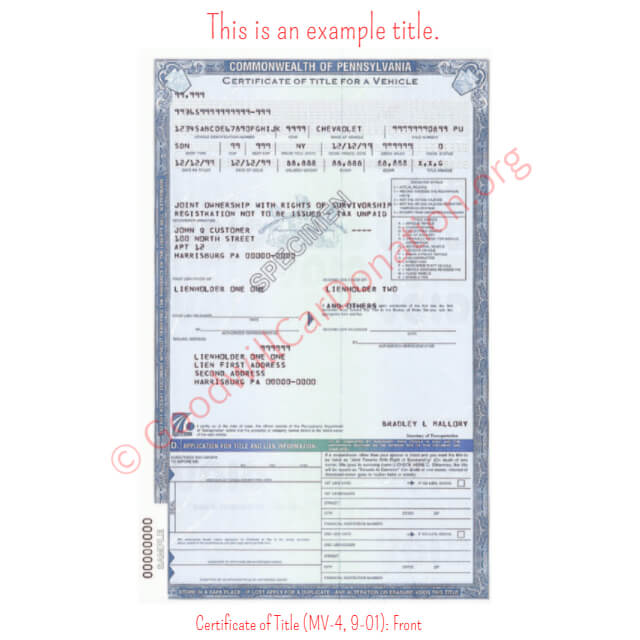

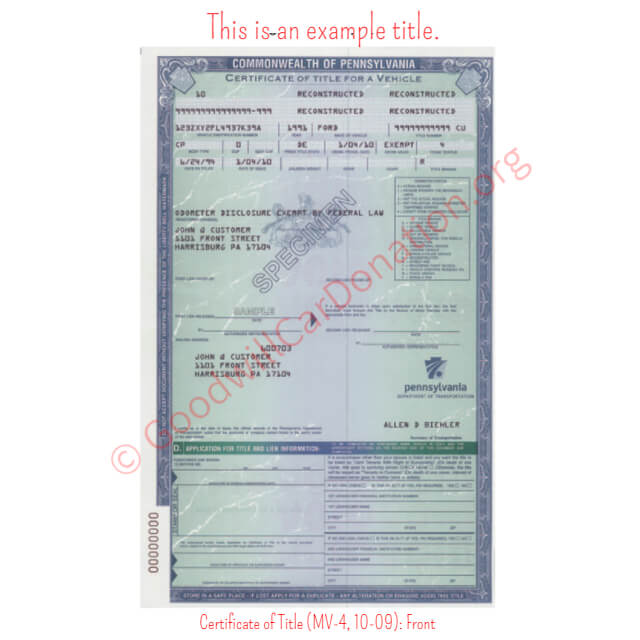

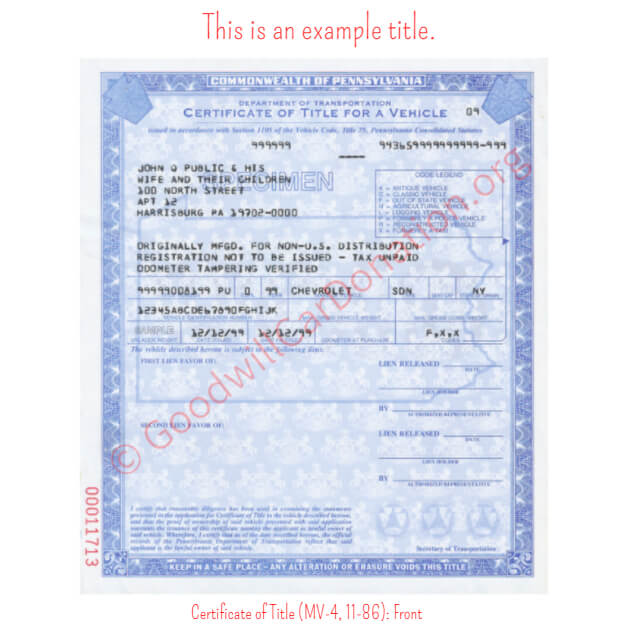

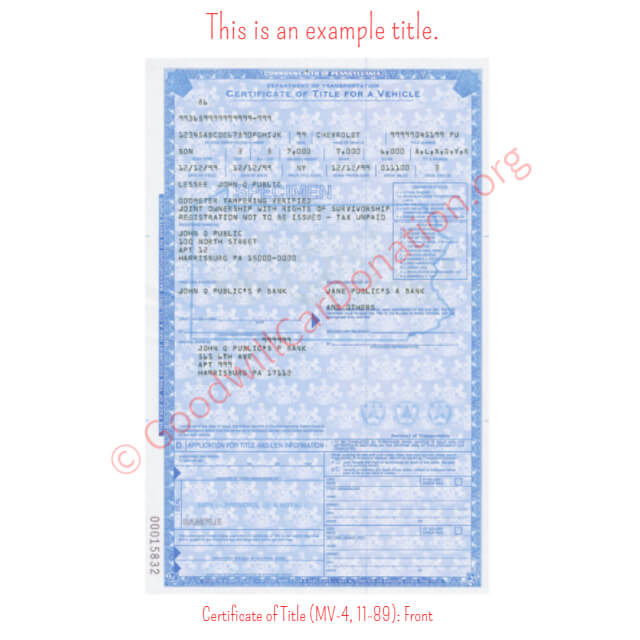

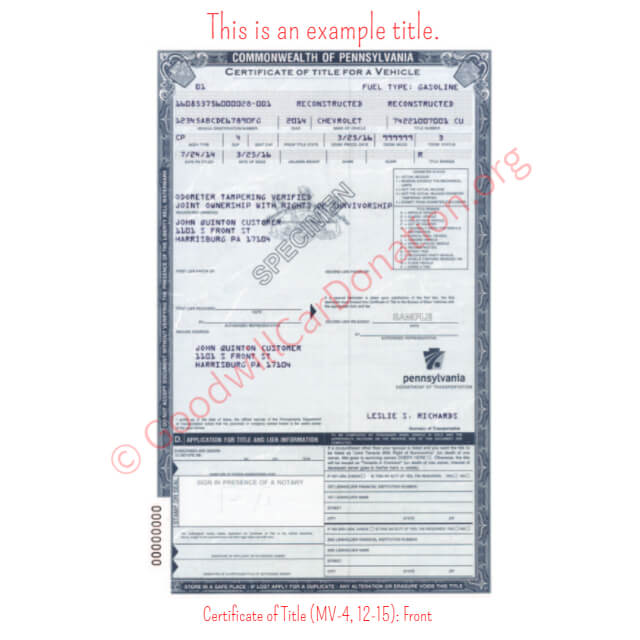

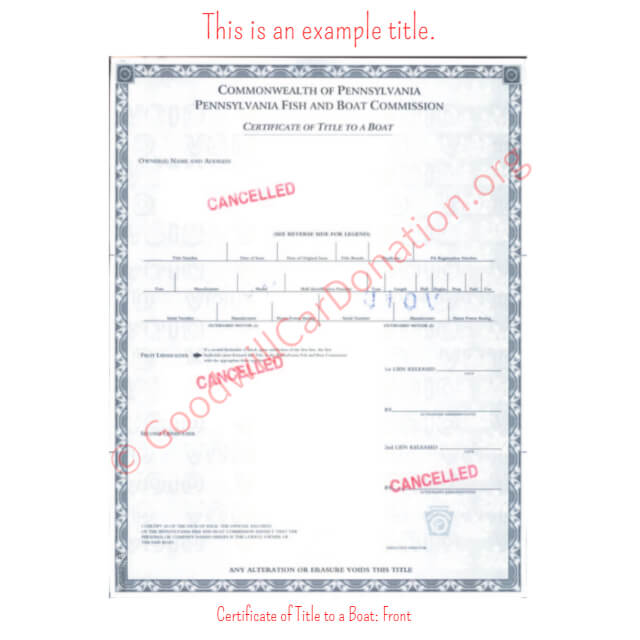

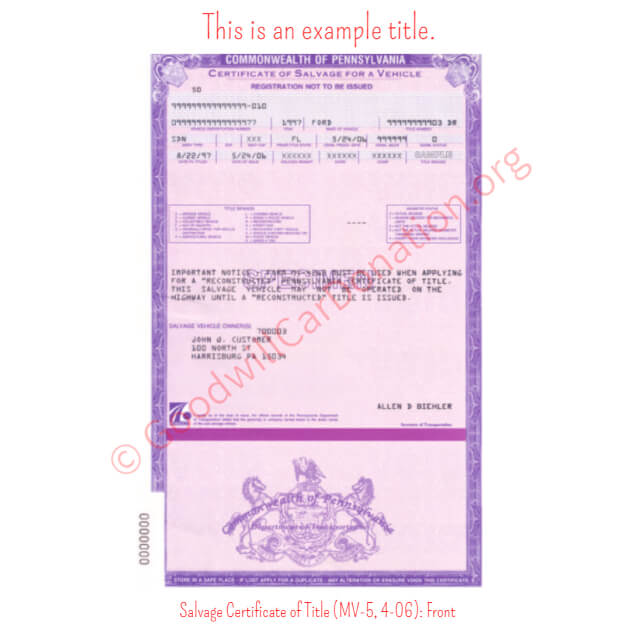

To help with your donation, we have showcased the various Pennsylvania vehicle titles below as well as annotated on each title where to print and sign your name. To enlarge an image, simply click on the image. Questions? Give one of our friendly Title Clerks a call at (866) 233-8586.

Note: Actual title designs may vary slightly from the images shown above.

Official Pennsylvania Government Links & Contact Info

- County Title Offices

- Obtain Vehicle Specific Information

- Unclaimed/Abandoned Vehicles

- Vehicle Title FAQs

- Vehicle Title Forms

Contact the Pennsylvania Department of Transportation: 717-412-5300

Contact the Pennsylvania Department of Transportation – Title Division: 717-412-5300, option 2 and 4 for Title inquiries.

Pennsylvania Vehicle Titles: How To For Multiple Owners

If there is more than one owner listed on the title, one or both must sign it depending on how the names appear. See the below chart for details.

Remember, the name used to sign the title must match the name shown on the title exactly. Therefore, always remember to print/sign your name exactly as it is shown on the title.

|

John Doe OR Jane Doe |

If “OR” is present between the names, only one of the owners must sign the title. |

|

John Doe AND/OR Jane Doe |

If “AND/OR” is present between the names, both owners must sign the title. |

|

John Doe AND Jane Doe |

If “AND” is present between the names, both owners must sign the title. |

|

John Doe Jane Doe |

If there is nothing present between the names, both owners must sign the title. |

Please take note to adhere to the below instructions so as not to void your title.

- Do not use markers or pencils. Only blue or black pen are allowed.

- Do not cross out or strikethrough any text or writing.

- Do not use white-out or similar substances.

- Do not rip, tear, or tape the title.

- Do not doodle on the title.

Still Have Questions? Find Your Answers Below!

What Papers Do I Need Besides the Title to Transfer a Car?

PennDOT requires a handful of supporting documents when you sign a Pennsylvania title.

- Form MV-4ST, the Vehicle Sales & Use Tax Return/Application for Registration (available only from authorized agents)

- A valid Pennsylvania driver’s license or photo ID for each new owner

- Proof of insurance (card, binder or declaration page)

- A notarized bill of sale if price or gift status could later be questioned

- Lien-release paperwork if a lender once held the title

How Long Does It Take to Transfer a Vehicle Title?

After a buyer and seller complete the title in front of a PennDOT-approved notary or tag agent, the application is forwarded to Harrisburg electronically or by overnight mail. Processing usually runs two to six weeks, with online or “agent-connected” filings arriving toward the shorter end of that range. Mailing paper packets can add extra days for shipping and data entry.

Are There Fees or Taxes When Transferring a Title?

Pennsylvania updated its schedule under Act 89, so be ready for three key charges:

- Title certificate fee – $67 (raised from $58 in July 2023)

- Sales/use tax – 6% statewide; 7% in Allegheny County; 8% in Philadelphia

- Local service fees a notary or messenger may add for processing

If you record a lien, PennDOT assesses an additional $100 lien-recording/title combo fee.

Can I Transfer a Title If I Lost the Original?

Yes. The titled owner first files Form MV-38O for a duplicate certificate and pays the duplicate-title fee listed in MV-70S. If the original was lost in the mail, PennDOT waives the fee when the request is made within 90 days of issue. Once the duplicate arrives, simply sign and notarize it as you would any other title.

What If the Buyer and Seller Live in Different States?

The seller follows Pennsylvania signing rules – front and back of the title completed before a Pennsylvania notary or agent – then hands the buyer the executed document. The buyer will meet the registration, emissions and tax rules of their home state, submitting either Form MV-1 (for an out-of-state title) or that state’s equivalent. A VIN inspection or emissions test may be required before plates can be issued.

How Do I Fix Mistakes on a Vehicle Title?

PennDOT treats any scratch-outs or correction fluid as a defacement. Instead, complete the state’s “Statement of Facts” or other correction form (often handled by the notary), supply proof (such as an ID copy confirming the correct spelling) and pay the title-correction fee. The agency will issue a clean replacement so the transfer can proceed without red flags.

What Happens If I Transfer a Title Wrong or Fake It?

An inaccurate odometer reading, forged signature, or back-dated sale can void the transfer. PennDOT can refuse registration or even seize plates until the error is cured. Deliberate falsification exposes both parties to fines and potential criminal fraud charges. Civilly, a buyer may sue to rescind the sale or recover damages for undisclosed liens.

Can I Transfer a Title Without the Seller Being There?

This can only happen if the seller has already signed the Pennsylvania title in the presence of a notary, considering Pennsylvania makes notarization mandatory. Many sellers execute a limited power of attorney (Form MV-POA) so the buyer can finish any paperwork the seller cannot attend in person. Without a notarized seller signature, the DMV agent must reject the packet.

How Do I Transfer a Title When Giving a Car as a Gift?

Write “gift” and $0.00 in the purchase-price box, then attach Form MV-13ST, Affidavit of Gift. The recipient still supplies ID and insurance, pays the $67 title fee, but is exempt from sales tax if the donor is an immediate family member or if exemption 13 applies. Both parties must still sign before a notary.

How Soon Must I Transfer the Title After Buying a Car?

Under PennDOT rules, the purchaser must submit the notarized title and MV-4ST packet within 20 days of the signing date. Missing that deadline risks late fees from the tag agent and citations if the vehicle is stopped while still titled to the seller.

What Are the Benefits of Donating Your Vehicle Instead of Selling It Privately?

Choosing Goodwill Car Donations streamlines the process and strengthens Pennsylvania communities:

- Tax advantage: You may deduct the full auction sale price or fair-market value, lowering your taxable income.

- Free statewide towing: Goodwill schedules pickup anywhere from Philadelphia to Pittsburgh, Allentown, Erie, Reading and every neighborhood in between.

- Zero selling headaches: Skip listings, test-drives and title haggles. Goodwill handles the paperwork through licensed agents when you donate any automobile, including cars, vans, pickup trucks, sedans, SUVs, sports cars, and more.

- Community impact: Proceeds fund local job training, employment services and educational programs that uplift your neighbors.

If you have a car you no longer use, turn the keys into opportunity. Schedule your donation with Goodwill today and help fellow Pennsylvanians move forward.

Last Updated: July 7th, 2025